Written by Nicholas D. Kristof

Published: http://www.nytimes.com/2009/12/31/opinion

Editor's Note: I'm deeply involved with Emerge Lending and interested in other payday loan alternative programs so this article took me back. Sometimes we become so immersed in one solution to a problem that we forget the other. Kristof stimulates a whole different perpective with good writing and good examples, such as www.matchsavings.org. What an wonderful concept for giving! [more]

Sparking a Savings Revolution

Sparking a Savings Revolution

Written by Nicholas D. Kristof

There’s an old saying about poverty: Give me a fish, and I’ll eat for a day. Give me a fishing rod, and I’ll eat for a lifetime.

There are many variations in that theme. In Somalia, I heard a darker version: If I buy food, I’ll eat for a day. If I buy a gun, I’ll eat every day.

But these days, there’s evidence that one of the most effective tools to fight global poverty may be neither a fishing rod nor a gun, but a savings accounts. What we need is a savings revolution.

Right now, the world’s poor almost never have access to a bank account. Cash sits around and gets spent — and, frankly, often spent badly.

“We used to buy a three-liter bottle of Coke every day,” recalled Socorro Machado, a 49-year-old homemaker in a village here in northwestern Nicaragua. That was a bit less than a gallon, and the cost of $1.75 consumed a large share of the family’s budget.

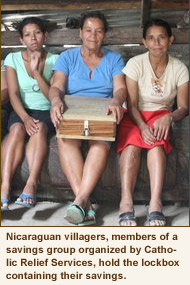

Then Catholic Relief Services, an aid organization, arrived in the village with a new program to promote savings. It provided a wooden box with a padlock and organized savings groups of about 20 people who meet once or twice a month, typically bringing 50 cents or $1 to deposit in the box.

Some of the money is lent out to start a small business, but the greatest benefit of these programs seems to be that they provide a spur to save.

“Now we buy a bottle of Coke just once a week, and we put the money in savings,” Ms. Machado said. She saves about $5 a month in her own name and another $5 a month in her son’s name and has plans to buy a computer for him eventually.

Some people in the development world argue that microlending has been oversold, and there has been a bit of a backlash against it lately — including a “no pago” movement here in Nicaragua. This “don’t pay” effort has been orchestrated by the leftist government of President Daniel Ortega.

I don’t agree with the criticisms of microloans, for I’ve seen how tiny loans can truly transform people’s lives by giving them the means to start small businesses. Even so, there’s evidence that the most powerful element of microfinance is microsavings, not microloans.

One of the ugly secrets of global poverty is that a good deal of suffering is caused not only by low incomes but also by bad spending decisions. Research suggests that the world’s poorest families (typically the men in those families) spend about 20 percent of their incomes on a combination of alcohol, cigarettes, prostitution, soft drinks and extravagant festivals.

In one village here in Nicaragua where children were having to drop out of elementary school because they couldn’t afford notebooks, a midwife, Andrea Machado Garcia, estimated to me that if a man earned $150 working in the mountains as a day laborer during the coffee harvest, he might spend $50 on alcohol and women and bring back $100 to support his family.

In one village here in Nicaragua where children were having to drop out of elementary school because they couldn’t afford notebooks, a midwife, Andrea Machado Garcia, estimated to me that if a man earned $150 working in the mountains as a day laborer during the coffee harvest, he might spend $50 on alcohol and women and bring back $100 to support his family.

One challenge is that those men don’t have a good, secure way to save money, and neither do poor people generally. It just sits around, itching to be spent. It’s also vulnerable to theft, covetous family members and demands for loans from relatives.

In West Africa, money collectors called susus operate informal banks but charge an annualized rate of 40 percent on deposits. Yes, you read that right. You pay a 40 percent interest rate on your savings!

In Kenya, two economists conducted an experiment by paying the fees to open bank accounts for small peddlers. They found that the peddlers who took up the accounts, especially women, enjoyed remarkable gains. Within six months, they were investing 40 percent more in their businesses, typically by buying more goods to be resold.

Many aid groups including CARE and Oxfam now offer savings programs in some form, and the Bill and Melinda Gates Foundation is studying how best to promote financial services for the poor. A Web site, www.matchsavings.org, lets donors match a poor person’s savings to increase the incentive to build a savings habit.

So it’s time for a global microsavings movement. Poor countries should ease the regulations (such as requirements for banking licenses) that make it hard for nonprofits to operate microsavings programs.

Hugh Aprile, a Catholic Relief Services official here, noted that savings schemes are very cheap to start because no capital is used to provide loans. “It’s people using their own money,” he said, “to build far more than they ever thought they could.”

Maybe it’s hard for us to believe considering how much animus there is toward fat-cat bankers in the United States, but the world’s poor might benefit hugely from the ability to bank their money safely.