Editor’s Note: Thanks to Caitlin, my beloved daughter, this song came on my annual Christmas mix. Alexi Murdoch is new to me and since I love poets who double as songwriter/singers, I’ll be checking out his music. So many things I care about are all captured here: Beautiful Lake Erie sunsets, my sisters, my brothers and every friend I can count on.

Orange Sky | Alexi Murdoch

Jan 31, 2018 6:12:19 AM / by Tim McCarthy posted in Creativity & Favorites

Invictus | William Ernest Henley

Jan 31, 2018 6:11:04 AM / by Tim McCarthy posted in Creativity & Favorites

To Resist or Embrace

Jan 1, 2018 12:06:22 AM / by Tim McCarthy posted in Monthly Newsletter

I’m mentoring a young man whose great strength and weakness is his energy. His mind runs at 100 MPH and it only turns off when he sleeps, if he does in fact sleep.

January Cartoon

Jan 1, 2018 12:04:19 AM / by Tim McCarthy posted in Creativity & Favorites

Money and the Meaning of Life | Jacob Needleman

Jan 1, 2018 12:03:21 AM / by Tim McCarthy posted in Creativity & Favorites

Editor’s note: If you’re not into philosophy, don’t buy this book. If you are, don’t miss it. It was first published in 1991. Its truths are age old and forever our future. The essential question Needleman explores is how our relationship to money affects our view of ourselves and our mortal journey. Whether our perception is having enough, having too much or too little Needleman uses his writing to urge us to put money in its context. Unlike most books taking one side or the other, Needleman suggests today one must recognize both the evil and the good. If we are not consciously aware he wonders if money is a prison cell we occupy not knowing that we are in jail. While poignant and spiritually based, the writing is very reachable using short chapters and many stories make its points.

Arnold H. Glasow

Jan 1, 2018 12:02:47 AM / by Tim McCarthy posted in Creativity & Favorites

“A good leader takes a little more than his share of the blame, a little less than his share of the credit."

-Arnold H. Glasow

The World in 2018 | The Economist

Jan 1, 2018 12:01:30 AM / by Tim McCarthy posted in Learning and Knowledge

Editor’s note: For this one time, I’ve chosen a magazine of the month. I finally broke down and bought a subscription to The Economist in 2017 having only enjoyed airport newsstand copies when I was in the mood. It’s been a good purchase. This bonus issue came before the holidays then and I found it fascinating. Their writing is excellent, topics are well chosen and as with all predictions, a certain boldness is required. Purchase or read what you can online. It’s well worth the time.

Egypt Road | John Zingg

Dec 29, 2017 12:02:09 AM / by Tim McCarthy posted in Creativity & Favorites

John Zingg and I played music together in college and were close friends during tumultuous times. Since retiring a year ago, John works on his music with daily discipline. His goal is to create original music after playing mostly in cover bands his entire life. Here’s one of his early instrumentals. If you enjoy the sound as I did, just let me know and I’ll get you on the list for his first EP, due out this coming year.

Rush to Judgement

Nov 30, 2017 12:11:52 PM / by Tim McCarthy posted in Monthly Newsletter

Let’s face it, we all rush to judgment at times.

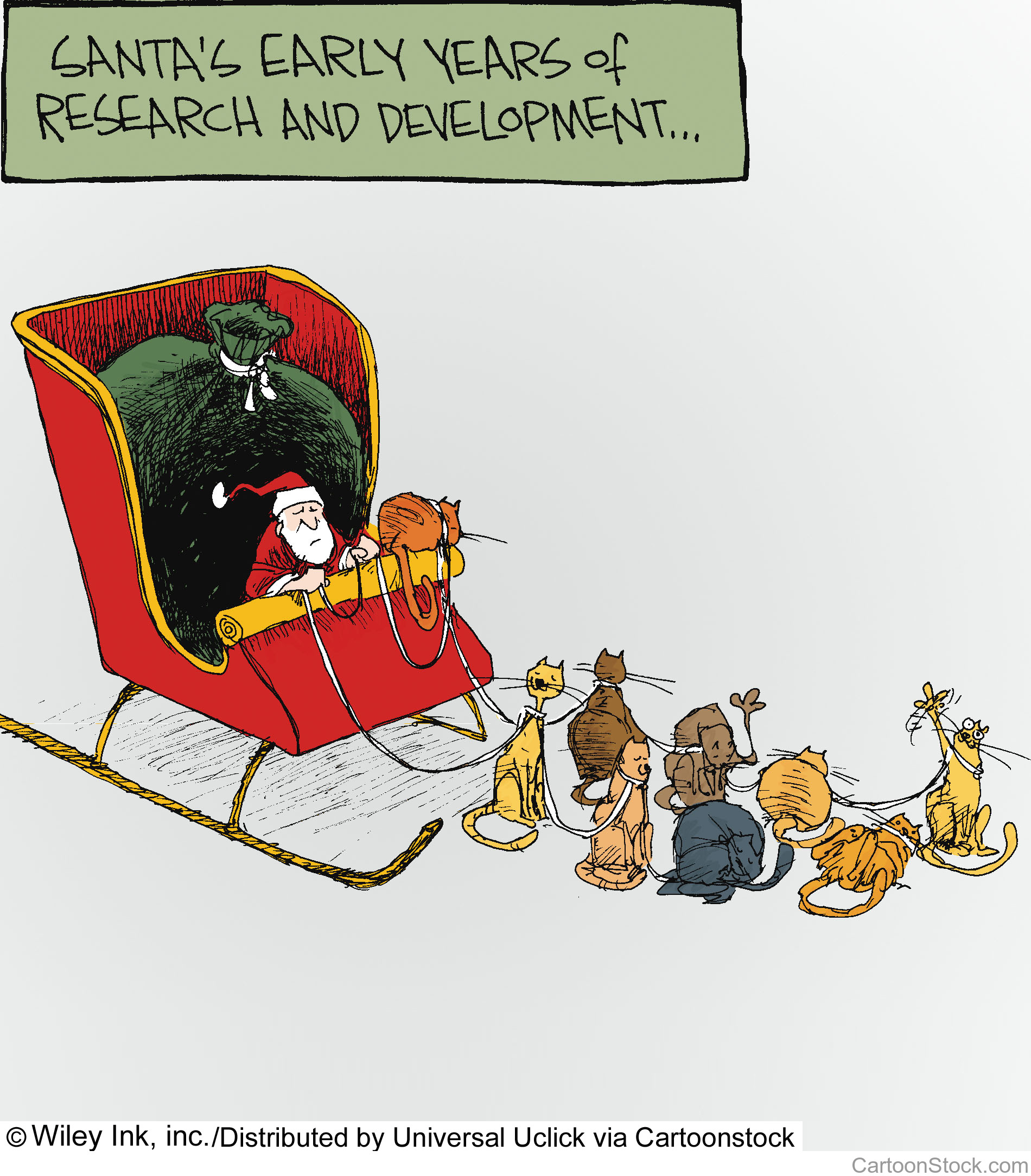

December Cartoon

Nov 30, 2017 11:54:18 AM / by Tim McCarthy posted in Creativity & Favorites